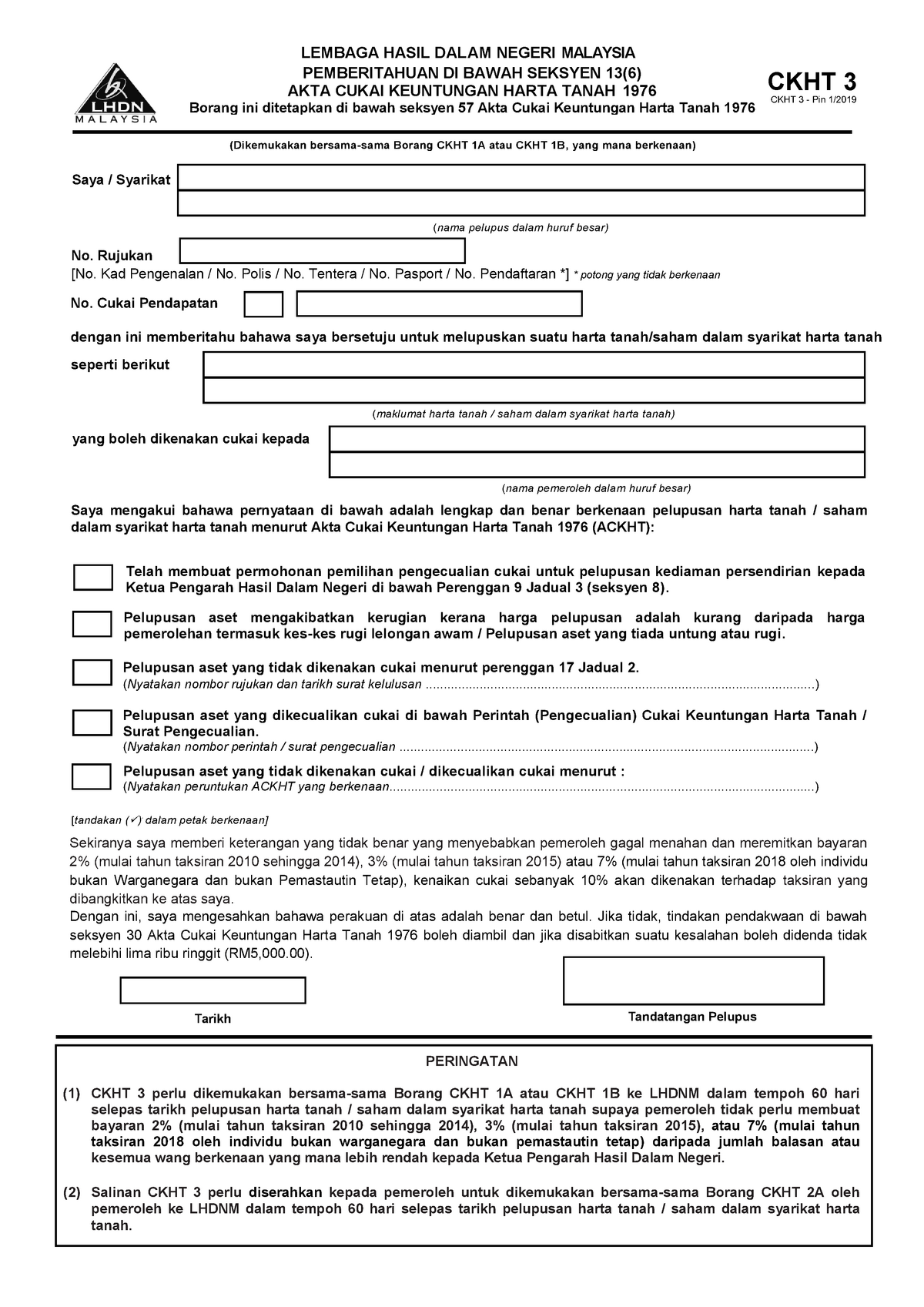

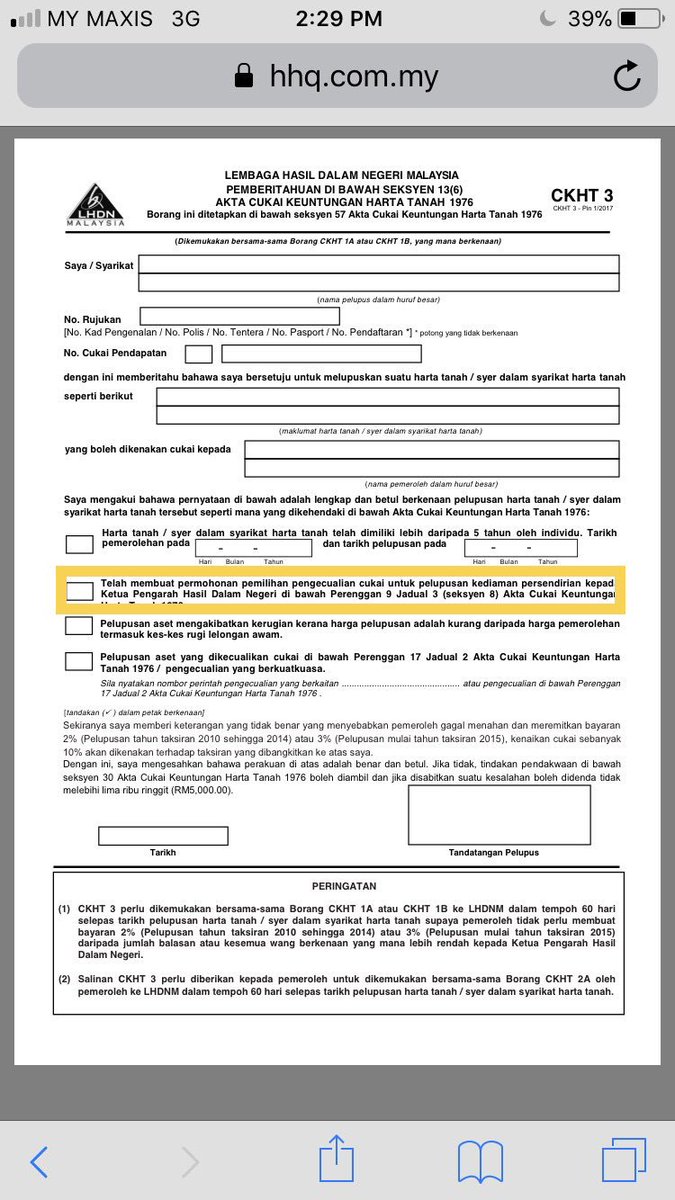

form ckht 3

Fill out the Disposal of Real Property CKHT 1A form the Sale and. Stamp Duty Due to the crippling effects of Covid-19 pursuant to the National Economic Recovery Plan on 5 June 2020 the following Exemption.

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

For companies instead of filling in Form CKHT 1A you are required to submit the following.

. Form only useable until 2022 form updated in LHDN website borang lembaga hasil dalam negeri malaysia pemberitahuan di bawah seksyen 136 akta cukai keuntungan. If the seller wants to reduce his RPGT he must provide all relevant bills such as legal fees stamp duties and other expenditures that allow for the RPGT deduction. Form needs to be able to cater for more than 1 acquisition date.

Salinan CKHT 3 perlu diserahkan. After the above-mentioned forms have been filled make sure to. 2022 -Jumlah Pengguna.

3 Penalti di bawah Subseksyen 293 ACKHT 1976 akan dikenakan sekiranya gagal mengemukakan Borang CKHT 1A pada atau sebelum tarikh akhir pengemukaan. CKHT 3 perlu dikemukakan bersama-sama Borang CKHT 1A atau CKHT 1B ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer yang tertakluk kepada ACKHT 1976 supaya pemeroleh tidak perlu membuat bayaran di bawah Seksyen 21B kepada Ketua Pengarah Hasil Dalam Negeri. Contoh Surat Pembahagian Harta untuk LA.

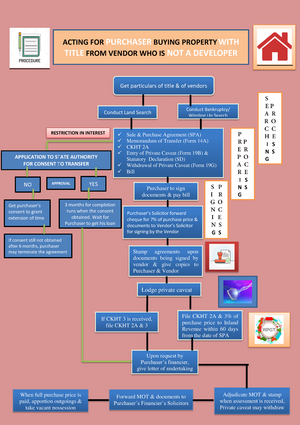

SS - CKHT Form 3. In the event there is profit the purchaser lawyer has the right to retain 3 of the purchase price foreigner 7 as a retention sum to Inland Revenue by filing. Transaction of disposal and acquisition for property only Form CKHT 1A CKHT 2A CKHT 3.

In many situations the shares could have been acquired by the disposer on different dates. CKHT 3 perlu dikemukakan bersama-sama Borang CKHT 1A atau CKHT 1B ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer yang tertakluk kepada ACKHT 1976 supaya pemeroleh tidak perlu membuat bayaran di bawah Seksyen 21B kepada Ketua Pengarah Hasil Dalam Negeri. It is worth noting.

This only applies if it is a transfer by way of love and affectiongift to others not within the family relationships stated above. Kes nomini Jika dalam perjanjian menyatakan A bertindak sebagai nomini kepada B pemilik harta tanah oleh itu. CKHT 3 MALAYSIA CKHT DALAM NEGERI PEMBERITAHUAN DI BAWAH SEKSYEN 136 AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976 Borang ini ditetapkan di bawah seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976 b Syarikat dengan ini memberitahu bahawa saya bersetuju untuk melupuskan suatu harta tanahsyer dalam syarikat harta tanah 3 - Pin 12020 seperti berikut.

Disposal of assets which involved one acquisition date only. CKHT 3 - Pin. Circular No 2192014 Dated 2 Oct 2014.

Form CKHT 3 shall be filed if there is no profit. You may also include any other. FORM 2 Annulment of Marriage.

Form CKHT 1A Disposal of Real Property attached with the SPA and all relevant documents that support your application for RPGT. Based on Form CKHT 1A submitted by the seller the IRB will then assess the requisite RPGT chargeable and refund the balance of the 3 retention sum if any to the seller. Close suggestions Search Search.

To Members of the Malaysian Bar. Form CKHT 3 Notification of Disposal of Asset not Subject to Tac or Exempt from Payment of Tax if the disposer wishes to apply for an exemption. As such the legal.

To obtain exemption and for disposal beyond 5 th year of acquisition the disposer will have to lodge the CKHT 3 Form together with the CKHT 1A within 60 days period from the disposal date normally the date of the Sale and Purchase Agreement. Muat Turun Borang - CKHT. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

CKHT Form 502 is the form for the remittance of the 3 retention sum by the purchaser to the LHDN. In general Form CKHT 1A is for details of vendor and sold property while Form CKHT 3 is for sellers who want to apply for tax exemption. CKHT 3 - Pin.

What We Do. If the disposal of an asset exceeds one acquisition date the submission of the Form CKHT 1A must be made manually. The sellers have the right to apply an exemption once in a lifetime or tax relief by submitting receipts on renovation fees lawyers fees brokerage fees for a tax deduction.

Borang 19G Penarikan Kaveat. Disposal of shares in real property company RPC Item C4 of CKHT 1B only provides 1 box for date of acquisition of shares. Tenancy Agreement for Room.

-Jumlah Pengguna Bulan. NOTA PANDUAN MENGISI BORANG CKHT 3 Bil Ruangan Catatan 1 Nama pelupus Nama pelupus yang lengkap Rujuk dokumen pelupusan. The form only allows for the filing of one disposal.

For the purchaser it is only required to file Form 2A and Form 502. RPGT Tax form CKHT 3 by crysenna. Form 502 for each vendor RM 150.

Amended Form CKHT 3 of Real Property Gains Tax Available on LHDNMs Website. 7 2022 -Jumlah Pengguna Tahun. 8 2022 -Jumlah Pengguna Bulan.

MAKLUMAT ASAS PELUPUS AN. Conveyancing Questions for NCLM. Salinan CKHT 3 perlu diserahkan.

14A Latest I for transfer of property. We have been informed by the Inland Revenue Board of Malaysia Lembaga Hasil Dalam Negeri Malaysia LHDNM via a letter dated 20 Aug 2014 that Form CKHT 3 2014 Amendment is available. Schedule G Exercise Filled In convey Bennett v Bennett 1969 1 All ER 539 FULL CASE 2 Letter to Purchaser to Pay.

The CKHT 3 for a once in a lifetime exemption of RPGT for transfer of residential properties. Individual disposers acquirers who register as e-Filing users. For exemptions fill out form CKHT 3 Notification under Section 27 RPGTA 1976 5.

Real Estate and Project Development. As such the CKHT Form 3 is for now redundant. In certain circumstances the disposal date could be the date whereby the condition precedents in the.

If the seller is an individual selling the property after five years the seller or sellers lawyer will file Form CKHT 3 to apply to be exempted from the 3 retention sum payment.

What Is Real Property Gains Tax The Malaysian Bar

Procedure For Filing Real Property Gains Tax Form Malaysian Taxation 101

Lhdn New Forms Effective From Jan Ss Perfect Management Facebook

Sample Subsale Agreement Company Company

Sample Subsale Agreement Company Company

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

Lhdn New Forms Effective From Jan Ss Perfect Management Facebook

3 Flowchart Purchaser With Title Not A Developer Get Particulars Of Title Amp Of Vendors Studocu

10 Steps To Buying A Property Malaysian Litigator

Ckht 3 1 Good Ckht 3 Lembaga Hasil Dalam Negeri Malaysia Pemberitahuan Di Bawah Seksyen 13 6 Studocu

Zakwan Adenan On Twitter Exemption Of Rpgt Owner Vendor Pelupus Must Fill Up Form Ckht 1a Ckht 3 And Submit To Lhdn Accordingly Twthartanah Peguamhartanah Rpgt Https T Co Pl4vbclh8o Twitter

No comments for "form ckht 3"

Post a Comment